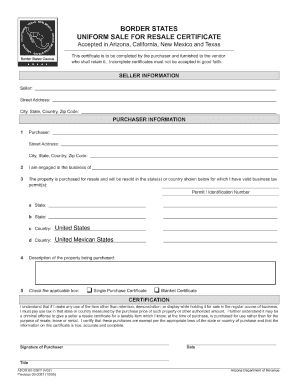

AZ ADOR 60- 2002-2024 free printable template

Get, Create, Make and Sign

Editing resale certificate arizona online

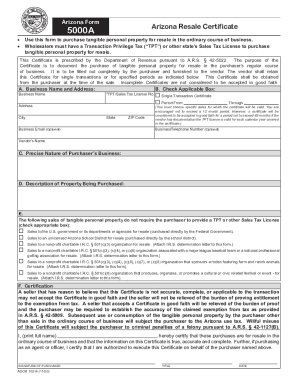

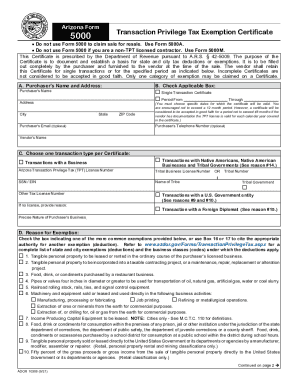

How to fill out resale certificate arizona form

How to fill out form 5000a certificate:

Who needs form 5000a certificate:

Video instructions and help with filling out and completing resale certificate arizona

Instructions and Help about certi arizona resale form

Hey guys Alex here from permitted, and today I'm going to show you how to get a sales tax permit in the state of Arizona also refers to their sales tax permits as a transaction privilege tax permit also referred to as the TPT there are two ways that you can get a TPT license the first is filling out a paper application and the second is filling out their online application for today's video I'm going to show you how to fill out the paper application because I think it's just a lot easier than going and creating an account and dealing with all the steps that are needed for the online application in general here at permitted we prefer to use the paper applications whenever possible because you don't have the data validation, and it's just a lot easier to just type something out on this form granted you do have to print it out and mail it in, but that's really negligible as long as you have some stamps and envelopes lying around since this form is pretty long all I'm going to do is point out the special areas that you should be paying attention to just because I want to make sure that you catch the important stuff, but before we begin filling this form out together I just want to make sure that you actually need to get a TPT license in the state of Arizona you need to get a TPT license if you have Nexus in Arizona and Nexus is defined in Arizona a little differently than some states, so you have the standard things such as if you have employees property inventory inside the state, but Arizona also is a little more specific in that they say that if you're building a market specifically in Arizona that you can also have Nexus there, and so they defined establishing and maintaining a market as soliciting sales making repairs collecting deep delinquent accounts delivering property installing products they have a couple different here, but this is different in that all you might be doing is marketing or selling products specifically to Arizona customers, and you might have Nexus there so let's say for example your business is selling air conditioners, and you go and start selling them to Arizonians saying you know beat the summer heat in Arizona you might now have Nexus there this is very nuanced and don't just think because you're selling to customers in Arizona that you have a sales tax obligation there it's not what I'm saying but just be aware of this nuance and reach out to an expert if you're unsure all right so let's hop into this form like I said I'm just gonna point out the areas that you really should be focusing on all right section 8 business information just wants your FDA and the social security number if you're an international seller you don't have an SS and reach out to us, we'll put you in contact with a partner who can help you get set up with sales tax permits inside the United States question 2 is asking you which type of permit are you looking to get, so you can get a TPT you can get that would be the TPT at the state level you can...

Fill arizona resale certificate example : Try Risk Free

People Also Ask about resale certificate arizona

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your resale certificate arizona form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.